This post is second in a series on the contemporary state of investment in the US. The first is here. The purpose of this post is to provide some definitions and context. There are three questions: first, what processes does “investment” refer to; second, who invests; and third, what patterns should interest us? To define and identify what investment activity matters (for economic growth and development in the US for the next decade or so), I rely mainly on some of the writings of critical/heterodox economists Hyman Minsky and John Kenneth Galbraith.

What is investment?

There are two common usages of the term “investment”. The first is the buying and selling of shares of companies that are publicly listed on stock exchanges. This set of activities is not the sort of investment I’m talking about in this post. No doubt, the stock market can be a source of capital for companies, which can then be deployed for investment. More often than not, however, the stock market functions as a market for corporate discipline and control (mergers, acquisitions, takeovers). The investment I refer to here is the accumulation of fixed assets (such as capital goods [like machinery], inventory, property, physical structures) for the purposes of generating income.

Let me offer a short digression here. Many would say that the two definitions above reflect a financial definition and then an economic definition of investment. In casual, daily conversation, that might be acceptable. However, if you have read Hyman Minsky then you would be aware that both processes are actually interlinked and co-constitutive. That is, the accumulation of fixed assets happens very much according to what is happening in capital markets (of which stock markets are a sub-set). More specifically, Minsky argues that the financing (particularly when financed through debt) and pricing of capital goods occurs in capital markets. The point is that the capital goods and fixed assets that are used for investment are also financial assets. And because these financial assets are accompanied by ownership claims and are financed, this implies that there are cash flow obligations: the debts that were used to finance capital goods accumulation must be validated. Those obligations are met by splitting off part of the income produced by those assets, either as dividends, interest payments, or perhaps (in dire situations) from the sale of capital goods. To make a long story short, Minsky demonstrates that these arrangements can precipitate a depression in the event that financial asset prices collapse, which he argues is possible if capital goods accumulation is financed in too speculative a manner. Otherwise stated, the capitalist system itself sows the seeds of its own crises. I suggest you read this or this.

Where does this leave our definition of investment? There are at least six elements: it refers to a (1) process of accumulating (2) capital goods, which are simultaneously (3) financial assets that are (4) owned by capitalists/entrepreneurs and (5) might be financed through debt, for the purposes of (6) generating income.

In the next section, I’m briefly going to discuss why (5) and (6) do not always apply but rather depend on who is doing the investing. Nonetheless, I think that the definition here is workable and sufficiently distinguishes this set of activities from the “investing” (asset trading) that commences every day with the ringing of the bell at the New York Stock Exchange.

There are a couple of other points I’d like to add here concerning how investment might influence the larger political-economy. Recently a book was released that contained a number of previously (I believe) unpublished essays by Hyman Minsky (they may have been published in a few academic journals) on the topic of jobs, employment, and welfare. I recommend this one, too, for a general introduction to Minsky’s thought and its application to employment. In the introduction and throughout that book, the reader might notice that the US economy is characterized as observing a “private, high-investment strategy”. I think there are two very important points in that phrase. First, investment is private: it is subject to ownership by individuals, not the state. This point should interest anyone who conducts cross-national comparative research: you cannot compare the investment process in a country like the US, where investment happens by entrepreneurs and households, with a country like China, where capital expenditures are determined largely by committees in state-owned businesses appointed by the (Communist authoritarian) state. It may be a minor point, but I think it is worth bringing up.

The second point is much more important: “high-investment strategy.” What does that imply exactly? The idea is that the US economy in particular generates growth by stimulating investment. That is, more private ownership of capital goods. Such a strategy is executed, in the US at least, by various policies: a tax code that favors capital goods accumulation (incentives for depreciation, tax credits); a favorable business environment (low regulation of business, which decreases the cost of doing business generally); and government contracts that partly underwrite profits in select industries, typically those that require high capital goods consumption (armaments, construction, airlines). Thus “growth” in the US economy is primarily pursued by creating favorable conditions for income generation by businesses.

There are number of problems associated with such a strategy, and I’ll quote the four that are mentioned in that volume on employment by Minsky. These can be found in a summary around kindle location 358-382.

First, a tax code that is geared towards more investment will increase inequality between the owners of capital and labor. For what it is worth, inequality on its own does not necessarily spell economic disaster. For instance, if you have read Thomas Piketty’s book, you’ll know that countries can endure long periods (centuries) of inequality without encountering, say, collapse and ruin. Certainly, there are issues of justice and quality of life that arise from high inequality, but the evidence that inequality might lead to economic and financial crisis is wanting. Politically, I don’t worry about inequality because the President and most American political leaders are not Rockefellers, Morgans, Vanderbilts, Carnegies, Fords, or Hearsts. In other words, the money eventually runs out.

[An aside: one of my favorite economists (Deirdre McCloskey) has recently written a review of Piketty that I suggest everyone read. It’s there on the home page in pdf form.]

Second, the income that accrues to owners of capital can lead to opulent consumption by them and emulative consumption by the masses, leading to inflation. There is a natural experiment here in the period 1964 to 1974 in the US, as employment tightened, defense spending escalated with the War in Vietnam, and the economy enjoyed an investment boom (initiated, by the way, with tax cuts passed during the Kennedy and Johnson administrations).

Third, government spending on defense (contracts to specialized and sophisticated high-technology industries) creates demand for high-skilled, high-wage labor. In turn, this widens the inequality among workers. Again, we can observe the effects of growth in high-technology sectors on wages and skills across occupations by observing the period from 1994 onwards, when the revolution in computer chips and the internet began. This was not totally the result of government spending (in fact, US defense spending dropped off after 1990, leading in part to the recession of 1991), although much of the US advanced technology industry grew out of companies that received defense contracts. Nonetheless, this is a serious problem for worker quality of life and, I would argue, for growth prospects between regions and metropolitan areas.

The final problem Minsky describes of a high private investment strategy is that if the tax code and business environment privilege capital spending, then rising business confidence hence banker optimism will erode lending standards while also increasing the riskiness and speculative nature of investment. The result can be a financial crisis and recession. It is worth noting that the 2008 crisis was not the result of excessive optimism by corporate businesses. Rather, the 2008 crisis was the result of a housing boom and a highly leveraged household and and highly leveraged, speculative, and corrupt financial sector.

At this point, I’ve elaborated enough on what I mean by investment. Now I’m briefly going to outline some key differences between the sources of investment.

Who invests?

I mentioned earlier in my definition of investment that it might be financed through debt and that the purpose of investment is to generate income. I’d like to add some caveats to that with the help of John Kenneth Galbraith.

In a previous post containing links, I had one from the St. Louis Federal Reserve documenting that credit to non-corporate non-financial sectors has remained low following the crisis. That to me was a key indicator of who is able and willing to invest in the current economy. We have at least three major groups here: the corporate sector (AT&T, Wal-Mart, ExxonMobil, DuPont, Microsoft); the household sector (you and me); and the financial sector (banks and lenders big and small). Each of these sectors have very different sources of capital and ways of generating income. The corporate sector, which as you can tell is populated by very large companies that are often structured in what economists would call an oligopolistic market (where they can influence prices of inputs and outputs), gets most of its capital (for the purposes of future investment) from retained earnings. In other words, expansion programs, research and development, development of new products are financed from last year’s profits. These business do not typically take out loans from banks to finance their activities, although they certainly float bonds and stocks as part of their complex capital structures. The main point is that these companies seek to make the supply of capital (like they do for all other strategic costs) a “wholly internal decision” (Galbraith, 2007, 34). Chapters Three and Four in The New Industrial State are the relevant backgrounds for this interpretation.

As such, investment is not necessarily financed through debt. In addition, investment may not happen with the aim of producing income. Galbraith describes that in these large corporate enterprises, the managerial hierarchy is responsible for long-term planning; this includes when and whether to make capital expenditures. The ultimate goal of the corporation, then, is not income or profit generation, but rather the elimination of uncertainty. The corporation seeks stability. The process of investment, we can deduce, will fall in line with how corporate managers attempt to achieve that stability. An oligopolistic market structure allows companies to pursue goals other than the relentless pursuit of profit, contra the neoclassical economics dicta.

In contrast, when American entrepreneurs attempt to launch a business, the financing usually comes from residential mortgages and the purpose is the generation of income (they do not exercise oligopolistic power). A home is an individual’s greatest potential source of capital, save inheritances. Consider how easy it is (excuse me, how easy it used to be) for most people to get a mortgage or to refinance their home; this, too, surely was a reflection of the high private investment strategy (or at least should be treated in policy as such).

Obviously, between the individual entrepreneur and the oligopolistic corporation, there are a lot of businesses that do not have pricing power and that have access to various forms of financing that are not restricted to home mortgages or inheritances. These businesses, which could be termed ‘mid-sized’ and have several hundred employees (let’s say, fewer than 500), and which are typically in manufacturing, transportation, utilities, and related industrial sectors, do enter into debt contracts with banks and other lenders. However, I think that our focus should really fall to entrepreneurs and large corporations. For the former, the reason is that small businesses create a tremendous amount of activity, in terms of jobs and sales. Most small business also fail, so this is a tremendously inefficient set of activities. In the short-term, however, small businesses drive quite a bit of local economic activity while providing a lot of people (not just the small business owners themselves but also the people they hire) with an outlet for social and economic advancement.

In the case of large corporations, the interests of these entities set much of the industrial and social policy in the US, and they are responsible for the bulk of exports and income. Furthermore, municipal and state governments compete quite vigorously over corporations. Local governments offer tax incentives, provide physical infrastructure, train the workforce, etc., partly with the aim of attracting business activity, and therefore tax revenue.

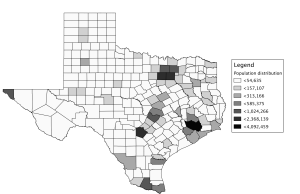

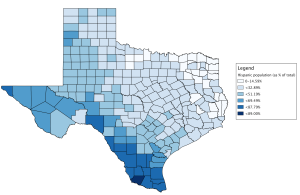

What I’m getting at here is that there is a geography of investment, and two very important features of that geography will be households and large corporations. The financial system is also important in this geography, but these days it is less about the location and activities of banks and more about the location, organization, and prerogatives of special investment funds, like pension or hedge funds. With that, I’ll move on to the final question.

Measuring investment and identifying patterns

I won’t dwell on this point much because instead of telling you what I’m going to do, I may as well just do it. In the next posts in this series, I’m going to present the data I stumbled upon from the Bureau of Labor Statistics for output, savings, and investment. The data is organized by sector, that is, industrial sector following the NAICS codes and also by the divisions suggested above (household, financial, corporate, and others).

The most basic pattern to identify is change over time: which areas demonstrate growth and which demonstrate contraction? There are roughly seven years of annual data, which is not a large sample by any means. There will be some noise.

A subsidiary pattern is relative change. The 2008 crisis marks a point where we can evaluate how credit distress during and after the crisis was distributed between sectors and, consequently, what have been and will be the prospects for investment and therefore economic growth. In other words, we can determine to an extent what sectors are “holding back” growth. Recall that this endeavor was largely touched off by the New York Times article that asked that very question (see previous post). My goal is to further investigate that question.